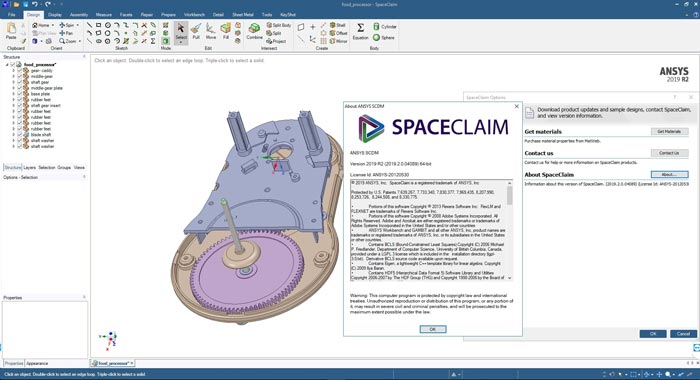

CAE companies collectively have shrugged this off. Autodesk, mostly a CAD company, has been buying up CAE companies to the tune of $300million. The answer to why ANSYS bought SpaceClaim may have more to do with Autodesk's actions of late. But why buy a capability you already have access to? And why pay $85 million for it? I doubt it would be justifiable in savings of license fees. It made sense, as modeling was hardly the strength of CAE programs, whereas it is a SpaceClaim specialty. SpaceClaim had signed up with ANSYS as their modeling front-end. SpaceClaim was already in bed with ANSYS. But also, SolidWorks was already perceived as a company on the rise.

Was it the channel? CAD insiders say Dassault bought SolidWorks for the reseller channel they had set up. That's a price of over 3.6 times as much as SpaceClaim, for less than one-sixth the number of seats. At the time SolidWorks had only 6,000 installed seats. $85 million may seem like a lot of dough at first, but compare this to what Dassault paid for SolidWorks, over $310 million 17 years ago. Bernie Buelow, VP of Marketing left not long after Blake. Marketing had been lackluster, consisting mostly of co-founder Blake Coulter tirelessly tweeting and talking his online friends into reviews of the product, plus the occasional press release about key customer wins. It doesn't look good when a co-founder leaves for a day job with another company in the same space - which is what Blake Coulter did in early 2013 when he surfaced at GrabCAD. Even perennial contender Solid Edge had risen to an order of magnitude larger. But not enough to change the big picture. The tactics seemed to vary with the weather.Īs late as December of last year, SpaceClaim claimed to have 40,000 seats.

The CAD world expected a lot from SpaceClaim: a promising startup founded in 2005 by none other than Mike Payne, whose previous companies - PTC and SolidWorks - forever changed mechanical design.

0 kommentar(er)

0 kommentar(er)